waaay early post.

May be the only post. I'm moving offices this morning. I hope to be up and running by the open.

I'll check the futures in the morning and let u know what I'm thinking bout movement then.

More to come below.

Have a good weekend.

GL and GB!

Thursday, April 30, 2015

Morning Charts 04/30/2015 SPX /es

Greece. They ain't go no money. Simple as that. this domino is gong to fall soon. the only question is can they contain the chain reaction that follows. It's going to get ugly soon. You really need to pay attention here.

Bund rout? But Germany is the backbone of the EU?

As I've warned for years here on STB - everyone will head for the gates (which are now closed) at once. When this thing turns the rush for the exits will be greater than ever seen before. Back in 2010 I forecated at least two market closures at such a time. I'm afraid I may have woefully underestimated that number. When The Herd Turns

On to the lie -

SPX 30m - 2100 is critical.

Freedom Watch -

Better safe than sorry, or are they part of the game? Texas Governor Calls Up State Guard To Counter Jade Helm "Federal Invasion" Fears

Also see TEXAS GOVERNOR FIGHTS GLOBALIST AGENDA

More to come below.

Have a good day.

GL and GB!

Bund rout? But Germany is the backbone of the EU?

As I've warned for years here on STB - everyone will head for the gates (which are now closed) at once. When this thing turns the rush for the exits will be greater than ever seen before. Back in 2010 I forecated at least two market closures at such a time. I'm afraid I may have woefully underestimated that number. When The Herd Turns

On to the lie -

SPX 30m - 2100 is critical.

Freedom Watch -

Better safe than sorry, or are they part of the game? Texas Governor Calls Up State Guard To Counter Jade Helm "Federal Invasion" Fears

Also see TEXAS GOVERNOR FIGHTS GLOBALIST AGENDA

More to come below.

Have a good day.

GL and GB!

Wednesday, April 29, 2015

Morning Charts 04/29/2015 SPX /es

Heck, I could not phrase this any better, there is nothing more to say, so from Futures Flat On FOMC, GDP Day; Bunds Battered After Euro Loans Post First Increase In Three Years

On to the lie -

SPX Daily - The wedge - this time it's grey cause all the red neg divs really screwed up the look of the chart.

Freedom watch -

Nothing here today. Gonna take a break from the dire side.

More to come below.

Have a good day.

GL and GB!

Well, there may be a bit more to say as buybacks surge assisting in masking market reality, Greece is just about cooked and Twitter may be the modern version of a tech bubble poster child. Ah, it's all good. Y'all just stay fully invested in the risk on new normal norm. What could go wrong? It's not like the dollar is in trouble, the economy is in the tank or the government is practicing martial law drills.

"Today we get a two-for-one algo kneejerk special, first with the Q1 GDP release due out at 8:30 am which will confirm that for the second year in a row the US economy barely grew (or maybe contracted depending on the Obamacare contribution) in the first quarter, followed by the last pre-June FOMC statement, in which we will find out whether Janet Yellen and her entourage of central planning academics will blame the recent weakness on the weather and West Coast port strikes and proceed with their plan of hiking rates in June (or September, though unclear which year), just so they can push the economy into a full blown recession and launch QE4."

On to the lie -

SPX Daily - The wedge - this time it's grey cause all the red neg divs really screwed up the look of the chart.

Freedom watch -

Nothing here today. Gonna take a break from the dire side.

More to come below.

Have a good day.

GL and GB!

Tuesday, April 28, 2015

Morning Charts 04/28/2015 SPX /es

OK, we got AAPL behind us, so the markets can now be unleashed to do what they will. Of course things have not changed with QE (anywhere in the globe) being the main driver. why did the futures dip? Simple, Failed Chinese Local Bond Offering Leads To PBOC Easing Confusion.

On to the lie -

Sideways action or a drift to the south leading into FOMS was my thoughts yesterday, and that appease to be what we have happening. You're gonna have to wait for the FOMC now before any real market moves happen (unless that is Fed speak of course).

SPX Daily - The wedge, the channel, the DoD, the double top, the ATH and all the negative divergences - 2062 is key support.

Freedom watch -

Do not ignore this - Baltimore streets fill with National Guard troops 15 police injured, 2 dozen arrested in fiery night of rioting.

This is Ferguson all over again but maybe worse. If you have not figured this out, police brutality is the issue and we're not gonna accept it. This means we have a will (suppression) vs. will (freedom) environment. The police have been militarized to prepare for this, and now you see why they want our guns.

Now consider Jade Helm and start connecting the dots. Connect all the dots I've tried to point out over the years. I hate to say that it appears we're nearing the end folks.

More to come below.

Have a good day.

GL and GB!

On to the lie -

Sideways action or a drift to the south leading into FOMS was my thoughts yesterday, and that appease to be what we have happening. You're gonna have to wait for the FOMC now before any real market moves happen (unless that is Fed speak of course).

SPX Daily - The wedge, the channel, the DoD, the double top, the ATH and all the negative divergences - 2062 is key support.

Freedom watch -

Do not ignore this - Baltimore streets fill with National Guard troops 15 police injured, 2 dozen arrested in fiery night of rioting.

This is Ferguson all over again but maybe worse. If you have not figured this out, police brutality is the issue and we're not gonna accept it. This means we have a will (suppression) vs. will (freedom) environment. The police have been militarized to prepare for this, and now you see why they want our guns.

Now consider Jade Helm and start connecting the dots. Connect all the dots I've tried to point out over the years. I hate to say that it appears we're nearing the end folks.

More to come below.

Have a good day.

GL and GB!

Monday, April 27, 2015

Morning Charts 04/27/2015 SPX /es

This is a good place to start, Key Events In The Coming Week: April FOMC And Q1 GDP. It's nice to at least know when some of the propagandist equation will arrive. As for the multitude of spontaneous just in time crud they spew, you are at their mercy.

And what is more important than knowing who or when moar QE will be infused? China Considers Launching QE; Shanghai Stocks Soar

And you always need more fuel for the fire - the Fed sees this, the CB's see it, the IMF and BIS see it - Is This A Blow-Off Top? Four Ways To Tell.

On to the lie -

See the charts from late last week if you want more of the devastating setup that exists at this time.

SPX Daily - New ATH and the severe negative divergences that I told you would come with the spike. The STB bull/bear line cross works again. They are batting 1000% on the cross of a 61% retracement of every major fall to battle back to a new ATH. Now, is it time for another black vertical overthrow line on the chart? Can they pull off the impossible again? Again, red critical wedge support and black STB DoD resistancenot far under red wedge resistance and LT channel resistance - price is trapped. One of two things will happen - they blast price into orbit here or wee get a 5 - 10% correction and then QE4 comes for the final stage of this manipulated market run.

SPX 60m - The wedge.

Freedom Watch -

Not on a Monday, Mondays are bad enough.

More to come below.

Have a good week.

GL and GB!

And what is more important than knowing who or when moar QE will be infused? China Considers Launching QE; Shanghai Stocks Soar

And you always need more fuel for the fire - the Fed sees this, the CB's see it, the IMF and BIS see it - Is This A Blow-Off Top? Four Ways To Tell.

On to the lie -

See the charts from late last week if you want more of the devastating setup that exists at this time.

SPX Daily - New ATH and the severe negative divergences that I told you would come with the spike. The STB bull/bear line cross works again. They are batting 1000% on the cross of a 61% retracement of every major fall to battle back to a new ATH. Now, is it time for another black vertical overthrow line on the chart? Can they pull off the impossible again? Again, red critical wedge support and black STB DoD resistancenot far under red wedge resistance and LT channel resistance - price is trapped. One of two things will happen - they blast price into orbit here or wee get a 5 - 10% correction and then QE4 comes for the final stage of this manipulated market run.

SPX 60m - The wedge.

Freedom Watch -

Not on a Monday, Mondays are bad enough.

More to come below.

Have a good week.

GL and GB!

Friday, April 24, 2015

Open Weekend Post 04/25-26/2015

You know the drill, share the love and the knowledge.

If you see it share it. I will as well.

Market in more than a precarious spot.

Have a good weekend.

GL and GB!

If you see it share it. I will as well.

Market in more than a precarious spot.

Have a good weekend.

GL and GB!

Morning Charts 04/24/2015 SPX /es

Staying on the market manipulation theme, read "I’m Not Crazy, I’m Scared" - Why For One Trader, This Time It Is Different.

On to the lie -

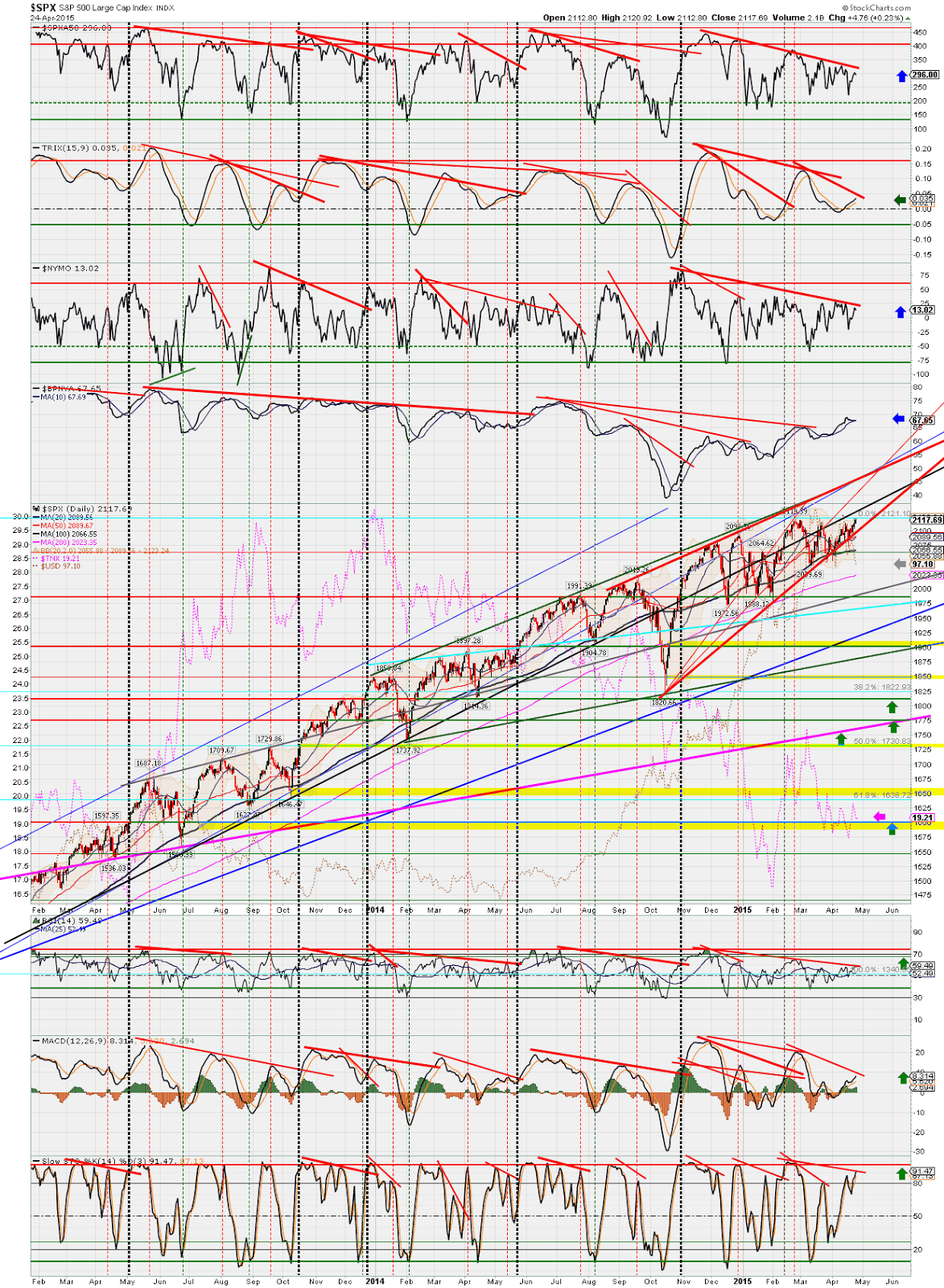

SPX Weekly - If this does not look like an end game scenario I'm not sure what does. These days one must qualify such a statement by adding the fact that the Fed and other forces completely manipulate the market, so what you see may be misleading. So you got (Blue) multi-year channel resistance being challenged, (Black) the STB Diagonal of Death having broken down and is now resistance and (Red) the rising wedge culminating it all. Folks that red wedge is like a huge ass road sign flashing red warning you that were about to run out of road, you have no breaks and there is a big ass cliff ahead. I've been discussing for a few weeks now how price is being compressed or is trapped between blue and black resistance and red support. I have discussed how red is critical support here. Hopefully this chart puts things in perspective for you. Oh, did I fail to mention all the negative divergences below in the indicators? My bad. Sorry. This market is technically gift wrapped and delivered to your doorstep for disaster.

Freedom watch -

Look, being right (for years) in the news and message I deliver really sucks. It's no fun to sit here day after day and warn you of the impending doom this market and country are facing. Hell, it's no fun to sit here an witness it either. All I hope is that you make an educated (while it's still legal) decision regarding you and your family's future based on the evidence here and elsewhere.

Take this post as further evidence of the control system we're soon to be placed under. Consider my multiple warnings to get your cash out of the system (the gates are closed remember), as in all the way out of the markets, banks and dollar into real assets. Please see Largest Bank In America Joins War On Cash.

Two words - cashless society. The ultimate control mechanism will come one day. This way they will be able to track every dollar (if they are called dollars much longer), every transaction, maximize tax collection and control you like never before. Great, they will be able to electronically cut off your water, power, car and your cash. Your only freedom will remain in the black market and your ability to barter. This is where real assets and physical items like gold, silver, cigarettes, booze and such come into play. You really need to think about the possibility of such things.

And to follow through with STB's libtard earth day hypocrisy from yesterday please see The Liberal Hypocrisy of Earth Day | ZoNation.

More to come below.

Have a good weekend.

GL and GB!

A wise central banker told me I should learn to live with central banks being the dominant force in the market, whether I like it or not. I, unhappily, think he is right.And staying with the what does bad = today question (yesterday it was bad = bad that dramatically changed to bad = good all the way to fresh new ATH's) - Worst Drop In Core Durable Goods Since December 2012. Hmmm ..... the futures were down again last night only to recover again (trend I've been pointing out). I guess bad = good again, phew, back to the new normal.

"and under the covers it is ugly - Capital Goods New Orders non-defense, ex-aircraft have now fallen for 7 straight months, missing expectatons dramatically (-0.5% vs +0.3% exp.). These numbers have never fallen for this long a period without a recession."

On to the lie -

SPX Weekly - If this does not look like an end game scenario I'm not sure what does. These days one must qualify such a statement by adding the fact that the Fed and other forces completely manipulate the market, so what you see may be misleading. So you got (Blue) multi-year channel resistance being challenged, (Black) the STB Diagonal of Death having broken down and is now resistance and (Red) the rising wedge culminating it all. Folks that red wedge is like a huge ass road sign flashing red warning you that were about to run out of road, you have no breaks and there is a big ass cliff ahead. I've been discussing for a few weeks now how price is being compressed or is trapped between blue and black resistance and red support. I have discussed how red is critical support here. Hopefully this chart puts things in perspective for you. Oh, did I fail to mention all the negative divergences below in the indicators? My bad. Sorry. This market is technically gift wrapped and delivered to your doorstep for disaster.

Freedom watch -

Look, being right (for years) in the news and message I deliver really sucks. It's no fun to sit here day after day and warn you of the impending doom this market and country are facing. Hell, it's no fun to sit here an witness it either. All I hope is that you make an educated (while it's still legal) decision regarding you and your family's future based on the evidence here and elsewhere.

Take this post as further evidence of the control system we're soon to be placed under. Consider my multiple warnings to get your cash out of the system (the gates are closed remember), as in all the way out of the markets, banks and dollar into real assets. Please see Largest Bank In America Joins War On Cash.

"Chase, the largest bank in the U.S., which has enacted a policy restricting the use of cash in selected markets; bans cash payments for credit cards, mortgages, and auto loans; and disallows the storage of "any cash or coins" in safe deposit boxes."

Two words - cashless society. The ultimate control mechanism will come one day. This way they will be able to track every dollar (if they are called dollars much longer), every transaction, maximize tax collection and control you like never before. Great, they will be able to electronically cut off your water, power, car and your cash. Your only freedom will remain in the black market and your ability to barter. This is where real assets and physical items like gold, silver, cigarettes, booze and such come into play. You really need to think about the possibility of such things.

And to follow through with STB's libtard earth day hypocrisy from yesterday please see The Liberal Hypocrisy of Earth Day | ZoNation.

More to come below.

Have a good weekend.

GL and GB!

Thursday, April 23, 2015

Morning Charts 04/23/2015 SPX /es

I'll open with this - and if any SOB comes at me about the markets not being manipulated you may just get bitch slapped into next week.Wake up people - facts are facts and it's about time you recognize this.

LOL - what does Bad = today? Futures Unexpectedly Red Despite Disappointing Economic Data From Around The Globe

On to the lie -

Once again the futures slide and recover. Not as severe as yesterday, but it is a pattern that needs to be watched indicating weakness that cash price action may not show.

SPX Daily - Any move to ATH (as I've been saying) will lead to (typical) rather harsh negative divergences and and overthrow of the neg divs.

SPX Daily - Again - critical red wedge support and black STB Diagonal of Death resistance. Price is trapped. Anything sub 2062 (triple major) support and hard hats may be required.

Freedom watch -

How long have the government funded and subsidized global warming alarmists been at it? How many years ago did they really begin to cook up all the mega propaganda to scare us into carbon credits and an expansion of government todeny us our rights protect mother earth? This post is absolutely priceless and a must read for several great laughs this morning. 18 spectacularly wrong apocalyptic predictions made around the time of the first Earth Day in 1970, expect more this year.

HYPOCRISY! at its finest is what you are witnessing. Why? One word, Fukushima. If these bleeding heart libtards were really interested in protecting the earth and the oceans then they would be focusing ALL their energy on solving the Fukushima disaster. I've yet to see some tree huger offer his or her life to go to Fuku to assist with this problem. Fucking bitch, bitch, bitch and then when it comes time for real action .... nothing. Typical.

How bad is Fukushima? Well, just start reading the headlines here and keep on clicking. This accident ranks in the top 5 coverups of all time and will be number one when it's all over (meaning it's ALL OVER as in this fucker is literally poisoning the globe and they are not doing one damn thing about it). Want to talk apocalyptic? Talk Fuku. This shits for real. Now these headlines are for real and not propaganda.

And see this and this - Update: Federal Judge drops bomb in the Monsanto vs. Maui case

More to come below.

Have a good day.

GL and GB!

"Deutsche Bank would pay $2.5 billion "in connection with the manipulation of the benchmark interest rates, including the London Interbank Offered Bank ("LIBOR"), the Euro Interbank Offered Rate ("EURIBOR") and Euroyen Tokyo Interbank Offered Rate ("TIBOR") (collectively, "IBOR").""

LOL - what does Bad = today? Futures Unexpectedly Red Despite Disappointing Economic Data From Around The Globe

On to the lie -

Once again the futures slide and recover. Not as severe as yesterday, but it is a pattern that needs to be watched indicating weakness that cash price action may not show.

SPX Daily - Any move to ATH (as I've been saying) will lead to (typical) rather harsh negative divergences and and overthrow of the neg divs.

SPX Daily - Again - critical red wedge support and black STB Diagonal of Death resistance. Price is trapped. Anything sub 2062 (triple major) support and hard hats may be required.

Freedom watch -

How long have the government funded and subsidized global warming alarmists been at it? How many years ago did they really begin to cook up all the mega propaganda to scare us into carbon credits and an expansion of government to

"1. Harvard biologist George Wald estimated that “civilization will end within 15 or 30 years unless immediate action is taken against problems facing mankind.”"

9. In January 1970, Life reported, “Scientists have solid experimental and theoretical evidence to support…the following predictions: In a decade, urban dwellers will have to wear gas masks to survive air pollution…by 1985 air pollution will have reduced the amount of sunlight reaching earth by one half….”

16. Sen. Gaylord Nelson wrote in Look that, “Dr. S. Dillon Ripley, secretary of the Smithsonian Institute, believes that in 25 years, somewhere between 75 and 80 percent of all the species of living animals will be extinct.”

HYPOCRISY! at its finest is what you are witnessing. Why? One word, Fukushima. If these bleeding heart libtards were really interested in protecting the earth and the oceans then they would be focusing ALL their energy on solving the Fukushima disaster. I've yet to see some tree huger offer his or her life to go to Fuku to assist with this problem. Fucking bitch, bitch, bitch and then when it comes time for real action .... nothing. Typical.

How bad is Fukushima? Well, just start reading the headlines here and keep on clicking. This accident ranks in the top 5 coverups of all time and will be number one when it's all over (meaning it's ALL OVER as in this fucker is literally poisoning the globe and they are not doing one damn thing about it). Want to talk apocalyptic? Talk Fuku. This shits for real. Now these headlines are for real and not propaganda.

‘Major blow’ at Fukushima as robot loses control inside reactor — Moved 10 meters before failing — Max radiation readings more than doubled since 2012 — ‘Eerie footage’ shows orange glow in area with highest levels

The Russians did a remarkable and heroic job handling Chernobyl. The russians had robots that failed as well, and people (biorobots) had to go in and remove the debris by hand. I don't see the same effort from Japan (or any tree hugers lining up to jump in to save the earth). Human sacrifice (and not just sending in the homeless of Japan to be sacrificed) is all that can save Fuku and possibly the oceans at this point.Times: 200-year wait faced at Fukushima — Plant Chief: “No idea” how to decommission reactors… “the technology does not exist”; “No viable method” to deal with melted fuel; “So many uncertainties… we don’t have accurate information” — Engineers declared problems ‘insurmountable’

And see this and this - Update: Federal Judge drops bomb in the Monsanto vs. Maui case

"This is dictatorship."

More to come below.

Have a good day.

GL and GB!

Wednesday, April 22, 2015

Morning Charts 04/22/2015 SPX /es

Greece, Fed and war - just be on your toes.

As for Greece, everyday the dominoes keep tumbling as the political jockeying continues. ECB Prepares To Sacrifice Greek Banks With 50% Collateral Haircut. And this may just be the beginning of the haircuts. I wonder, like the Cyprus situation, how many insiders are being allowed to exit haircut free while the little people are left to hang.

On to the lie -

I'm struggling with the fact that every time a downturn has passed the 61% retracement they've managed to march price to new ATH's. Things are apparently (and finally) becoming a little more difficult for team manipulation. A disconnected Fed does not help matters. More bothersome is the geopolitical stage from Ukraine to Yemen to Israel to Jade Helm here at home.

SPX Daily - You will prolly see this chart a lot in the next few weeks. It's really all there is to it.

Freedom watch -

Surreal? You tell me if this does not help connect the dots (immigration/economy/destruction of middle class) of an America where it appears they are trying to turn this country into a third world nation with cheap labor and ignorant debt slaves that are capable of doing little more than support the corprotocracy. Common Core's real goal? 'Dumbing down people'.

More to come below.

Have a good day.

GL and GB.

As for Greece, everyday the dominoes keep tumbling as the political jockeying continues. ECB Prepares To Sacrifice Greek Banks With 50% Collateral Haircut. And this may just be the beginning of the haircuts. I wonder, like the Cyprus situation, how many insiders are being allowed to exit haircut free while the little people are left to hang.

"The European Central Bank is now demanding that the value of the collateral that Greek banks post at their own central bank to secure these loans be reduced by as much as 50 percent,"

On to the lie -

I'm struggling with the fact that every time a downturn has passed the 61% retracement they've managed to march price to new ATH's. Things are apparently (and finally) becoming a little more difficult for team manipulation. A disconnected Fed does not help matters. More bothersome is the geopolitical stage from Ukraine to Yemen to Israel to Jade Helm here at home.

SPX Daily - You will prolly see this chart a lot in the next few weeks. It's really all there is to it.

Freedom watch -

Surreal? You tell me if this does not help connect the dots (immigration/economy/destruction of middle class) of an America where it appears they are trying to turn this country into a third world nation with cheap labor and ignorant debt slaves that are capable of doing little more than support the corprotocracy. Common Core's real goal? 'Dumbing down people'.

"“As just one example of how bad these national ‘standards’ are, consider that both of the subject-matter experts selected by Common Core’s own architects for the Validation Committee refused to sign off on them,” Newman revealed. “The math expert cited, among other problems, incorrect math. The English Language Arts expert blasted the fact that the standards will reduce the ability of children to think for themselves.”

In addition to imposing questionable standards, Newman reports the Department of Education is collecting obscene amounts of data on every student in the country – even data such as the number of teeth a child has lost and the condition of his or her gums.

“The data-mining schemes exposed in the book would make George Orwell blush,”"

More to come below.

Have a good day.

GL and GB.

Tuesday, April 21, 2015

Morning Charts 04/21/2015 SPX /es

Ah, the new normal, when good = good, bad = good and good can = bad. A true witches brew of fallacies and fantasies, concocted or not, that always seem to come out glowingly positive (in the matrix's eyes). When you get headlines like this you can only shake your head and pray that QE4 comes so they can just get it over with. Futures Surge On First Chinese State Bankruptcy, Greek Capital Controls And Approaching Default.

I hate to sound like a broken record, but Greece and Fed speak dominate everything (other than the false hopes for more #FAIL global QE to come).

And you need to read this to understand the new earnings normal - it's all about the buyback (and not just for IBM - they support roughly 30% of the market now). IBM Reports Worst Sales Since 2002; EPS Beats On Aggressive Buybacks, Cut In Tax Rate.

On to the lie -

SPX Daily - My life and a daily composite of everything we've watched and discussed since August of last year. The red rising wedge in detail. This is the third iteration of the wedge as they have adjusted the lower diagonal support to extend the wedge three times. The battle with critical support that I've annoyingly mentioned the past few weeks is clear to see. Volatile consolidation in the black triangle leading to the blue rising channel all at critical support leads to two options, either they defend and ramp or its about to collapse. Any spike to ATH levels will leave yet another nasty negative divergence (which in the past has led to some of the larger corrections).

Freedom Watch -

This has an angle on freedom, but mainly it highlights Chicago and the massive financial troubles going on there - this place is not just a social powder keg but a financial nuke about to go off. Credit Swap Event Triggers for Chicago Schools: Out of Cash in 30 Days, Cooking the Books to Oblivion:Rauner Ponders Bankruptcy; Emanuel Out to Destroy Middle Class.

Mish also has some excellent posts on Greece you need to skim over.

More to come below.

Have a good day.

GL and GB!

"Explaining the catalysts that move the "market" overnight has become so farcical it is practically an exercise in futility and absurdis."

I hate to sound like a broken record, but Greece and Fed speak dominate everything (other than the false hopes for more #FAIL global QE to come).

And you need to read this to understand the new earnings normal - it's all about the buyback (and not just for IBM - they support roughly 30% of the market now). IBM Reports Worst Sales Since 2002; EPS Beats On Aggressive Buybacks, Cut In Tax Rate.

"In other words, IBM is now in the aggressive collections business, just so it has the leeway to repurchase its own stock."

On to the lie -

SPX Daily - My life and a daily composite of everything we've watched and discussed since August of last year. The red rising wedge in detail. This is the third iteration of the wedge as they have adjusted the lower diagonal support to extend the wedge three times. The battle with critical support that I've annoyingly mentioned the past few weeks is clear to see. Volatile consolidation in the black triangle leading to the blue rising channel all at critical support leads to two options, either they defend and ramp or its about to collapse. Any spike to ATH levels will leave yet another nasty negative divergence (which in the past has led to some of the larger corrections).

Freedom Watch -

This has an angle on freedom, but mainly it highlights Chicago and the massive financial troubles going on there - this place is not just a social powder keg but a financial nuke about to go off. Credit Swap Event Triggers for Chicago Schools: Out of Cash in 30 Days, Cooking the Books to Oblivion:Rauner Ponders Bankruptcy; Emanuel Out to Destroy Middle Class.

More to come below.

Have a good day.

GL and GB!

Monday, April 20, 2015

Morning Charts 04/20/2015 SPX /es

LS2 in surgery this am for broken arm from last week. He's out now and all is well. Now having to run errand for LS1 school stuff. Sorry no post. I'll be in by 10.

More to come below.

Have a good week.

GL and GB!

More to come below.

Have a good week.

GL and GB!

Friday, April 17, 2015

Open Weekend Post 04/18-19/2015

You know the drill, share the love and the knowledge.

If you see it, share it. I will as well.

I'll look into the chartbook to see if there is anything interesting in there and let you know what I find.

LS2 becomes a teenager Saturday. LS2 broke his arm on Thursday on his new longboard! Boys. So much for gold for a while.

Have a good weekend.

GL and GB!

If you see it, share it. I will as well.

I'll look into the chartbook to see if there is anything interesting in there and let you know what I find.

LS2 becomes a teenager Saturday. LS2 broke his arm on Thursday on his new longboard! Boys. So much for gold for a while.

Have a good weekend.

GL and GB!

Morning Charts 04/17/2015 SPX /es

Easing/QE, it is what makes the world go these days, so we keep an eye on it and all announcements surrounding it. You can only laugh when stuff like this is pointed out - Is This How The Bank Of Japan "Signals" It Is About To Boost QE?. Front running your own manipulation? All you can do is laugh.

Greece - pay attention.

On to the lie -

Running thru some time frames - looks very toppy. fed speak yesterday was inconclusive meaning confusion still reigns. Markets don't like confusion. But, they have things under control with everyone knowing the Fed has the market's back and QE4 will come one day.

SPX Monthly -

SPX Weekly -

SPX Daily -

SPX 60m -

SPX 10m -

Freedom watch -

Coming on the back of yet another large ammo purchase (62 million AR-15 rounds) by the Feds (since they can't get the guns they will just take the ammo), and since we speculate on elite plans - you may want to read this - Signs That The Elite Are Feverishly Preparing For Something BIG. We've all been pointing to September for various reasons as a potential end point, maybe things are starting to come together.

How much longer will STB be allowed to broadcast its intolerable rants against the state? How much longer will we have freedom of the internet (or speech for that matter)? We often discuss all the built in on/off switches they have in place. See ‘Bloggers’ Compared to ISIS During Congressional Hearing

More to come below.

Have a good weekend.

GL and GB!

"As Bloomberg reports, BoJ stock has surged almost 30% in the last few days on very heavy volume... the previous 4 times we saw spikes in price and volume, Japanese authorities eased significantly in the following days."

Greece - pay attention.

On to the lie -

Running thru some time frames - looks very toppy. fed speak yesterday was inconclusive meaning confusion still reigns. Markets don't like confusion. But, they have things under control with everyone knowing the Fed has the market's back and QE4 will come one day.

SPX Monthly -

SPX Weekly -

SPX Daily -

SPX 60m -

SPX 10m -

Freedom watch -

Coming on the back of yet another large ammo purchase (62 million AR-15 rounds) by the Feds (since they can't get the guns they will just take the ammo), and since we speculate on elite plans - you may want to read this - Signs That The Elite Are Feverishly Preparing For Something BIG. We've all been pointing to September for various reasons as a potential end point, maybe things are starting to come together.

How much longer will STB be allowed to broadcast its intolerable rants against the state? How much longer will we have freedom of the internet (or speech for that matter)? We often discuss all the built in on/off switches they have in place. See ‘Bloggers’ Compared to ISIS During Congressional Hearing

"As linguist Noam Chomsky said, “The idea that there should be a network reaching people, which does not repeat the US propaganda system, is intolerable” to the US establishment."

More to come below.

Have a good weekend.

GL and GB!

Thursday, April 16, 2015

Morning Charts 04/16/2015 SPX /es

Greece - That's just about all you need to know. It's like a massive anchor dragging on the ocean floor, sometimes it grabs and the rest of the time it just keeps things slowed down a bit. This morning was one of those grab moments. I suggest you read this to understand just where Greece is.

That's "completely out of cash" in case you need that emphasized, as in bubkus, nada, niet, none, el zilcho in 14 days. This is real, I think we've finally reached the end of the road with Greece. Who is gonna lend them money now?

Capital controls may be the least of the worries as a country burns and global CDS start to sink like the Titanic. This may be another key to the banksters games coming to an inevitable end. The (long time STB hypothesized) Central Bank's "conduit" to flow funds (legal or not) to each other and to member banks thru Greece is about to go bye bye. This will possibly hit liquidity hard and possibly expose some hidden funding/transfer mechanisms they don't want exposed.

So now they cry to the IMF, Russia or anyone for help. Will they let Greece go? Will they allow a collapse? We're about to find out what Greece is worth to their system. Another bailout and we'll enter the 5th dimension of the parallel universe to absurdity which is whatever it is, but it ain't right.

On to the lie.

Earnings season continues to wow the CNBS disciples and woo the sheeple into believing all is well while the economic reports continue to disappoint. Who knows what's real anymore in the bad=good, good=good, good=bad world? Then throw in some classic Fed speak to stir the pot, and, as usual, we all reach for the Tylenol (or something stronger) to help us manage the situation. Bullard Hints The Fed May Hike Rates Only To Cut Them Right After is a classic example of this.

SPX 30m - Rising blue wedge into ATH resistance area

SPX 60m - the red rising wedge - it's getting kinda stale I know, but since we saw it coming back in August, it's all we have to discuss. Price interacting with all sorts of critical support and resistance in a tight knot is what it is here. It really looks and acts like a tired market that can't go any farther and its legs are about to fall out from under it (Greece?).

SPXBP - This is not good.

Freedom watch -

Study: Over 27% of Student Loans Are in Default is something you need to know. When our future is being financially raped and tied to the financial grindstone before they even get their feet wet, we got real problems. No bubble here, only an awesome glimpse at how prosperous our children will be! Two words - Debt Slave.

More to come below.

Have a good day.

GL and GB!

"Greek officials floated the idea of delaying payments to the IMF due shortly after the government runs completely out of cash at the end of April."

That's "completely out of cash" in case you need that emphasized, as in bubkus, nada, niet, none, el zilcho in 14 days. This is real, I think we've finally reached the end of the road with Greece. Who is gonna lend them money now?

"not to mention the fact that if the government defaults you would almost certainly see the imposition of capital controls in order to stem the inevitable deposit flight. Athens owes nearly €2 billion in public sector wages and pensions at the end of the month."

Capital controls may be the least of the worries as a country burns and global CDS start to sink like the Titanic. This may be another key to the banksters games coming to an inevitable end. The (long time STB hypothesized) Central Bank's "conduit" to flow funds (legal or not) to each other and to member banks thru Greece is about to go bye bye. This will possibly hit liquidity hard and possibly expose some hidden funding/transfer mechanisms they don't want exposed.

So now they cry to the IMF, Russia or anyone for help. Will they let Greece go? Will they allow a collapse? We're about to find out what Greece is worth to their system. Another bailout and we'll enter the 5th dimension of the parallel universe to absurdity which is whatever it is, but it ain't right.

On to the lie.

Earnings season continues to wow the CNBS disciples and woo the sheeple into believing all is well while the economic reports continue to disappoint. Who knows what's real anymore in the bad=good, good=good, good=bad world? Then throw in some classic Fed speak to stir the pot, and, as usual, we all reach for the Tylenol (or something stronger) to help us manage the situation. Bullard Hints The Fed May Hike Rates Only To Cut Them Right After is a classic example of this.

SPX 30m - Rising blue wedge into ATH resistance area

SPX 60m - the red rising wedge - it's getting kinda stale I know, but since we saw it coming back in August, it's all we have to discuss. Price interacting with all sorts of critical support and resistance in a tight knot is what it is here. It really looks and acts like a tired market that can't go any farther and its legs are about to fall out from under it (Greece?).

SPXBP - This is not good.

Freedom watch -

Study: Over 27% of Student Loans Are in Default is something you need to know. When our future is being financially raped and tied to the financial grindstone before they even get their feet wet, we got real problems. No bubble here, only an awesome glimpse at how prosperous our children will be! Two words - Debt Slave.

"The Fed determined that of the nearly $1.3 trillion in non-bankruptcy-dischargeable student loans, the delinquency rate for students in repayment is over 27 percent."

More to come below.

Have a good day.

GL and GB!

Wednesday, April 15, 2015

Morning Charts 04/15/2015 SPX /es

Tax Day! Oh joy!

Earnings season continues, so confusion will reign (for weeks).

Greece is waiting in the shadows.

BAC miss, but Draghi wants moar (#ECBQEFAIL) so all is well.

On to the lie -

SPX Daily - Any surge at all to new or near ATH will set up yet another/continue the long negative divergences that exist. The battle between critical support (red), and the resistance of the backtest of busted long term support (black) continues.

Freedom watch -

If you think "they" are not allowing or encouraging this you are wrong - open borders etc.... we're being set up. The August/September timeline for an "event" is starting to heat up.

ISIS Camp a Few Miles from Texas, Mexican Authorities Confirm

More to come below.

Enjoy paying the man today.

GL and GB!

Earnings season continues, so confusion will reign (for weeks).

Greece is waiting in the shadows.

BAC miss, but Draghi wants moar (#ECBQEFAIL) so all is well.

On to the lie -

SPX Daily - Any surge at all to new or near ATH will set up yet another/continue the long negative divergences that exist. The battle between critical support (red), and the resistance of the backtest of busted long term support (black) continues.

Freedom watch -

If you think "they" are not allowing or encouraging this you are wrong - open borders etc.... we're being set up. The August/September timeline for an "event" is starting to heat up.

ISIS Camp a Few Miles from Texas, Mexican Authorities Confirm

More to come below.

Enjoy paying the man today.

GL and GB!

Tuesday, April 14, 2015

Morning Charts 04/14/2015 SPX /es

Earnings season, this is the time I usually sit back, contemplate, watch and see what sort of magic they are going to reveal (or not). Earnings season is typically a time when technicals can be thrown out the window and daily trading becomes a crap shoot. As most know earnings season plays like this - a beat (due to GAAP trickeration with missed revenues) is followed by increased estimates and guidance across the board which everyone celebrates, then later come the downgrades (that are never punished cause QE is constantly in lift mode) which lower the hurdles for next quarter, and then they magically beat estimates again. Pretty simple stuff. Add the plethora of buybacks to the list this year and the waters become even murkier. Markets, especially the Q's, are in limbo till AAPL reports, so that's a month or so of simply waiting after the financials are finished for the market to make its final determination of how earnings season goes.

The problem is - does good = good, does good = bad or does bad = good? Liquidity, dollar, Greece, oil, rates; so many external factors these days overshadow earnings. What does the Fed need short term and long tern for earnings to say? How do they merge the two time periods? Confusion is the last thing the Fed needs now. they need either consistently bad or good, not in between. The markets want consistency now and are tired of this half and half crap they've been delivering over the past year or so.

On to the lie -

Now you tell me where to find the truth -

US retail sales rebound, post largest gain in a year

or

Retail Sales Misses For 4th Month In A Row For First Time Since Lehman

SPX 60m - Instead of battling critical support, price is now in a tussle with its first round of strong resistance. We've been watching this battle for some time now. Indicators are giving few clues as to direction.

Freedom Watch -

On the 1 year anniversary, the media and the government are still spinning the Bundy Ranch standoff misrepresenting the issues that led up to it and lying about what happened. See video here.

More to come below.

Have a good day.

GL and GB!

The problem is - does good = good, does good = bad or does bad = good? Liquidity, dollar, Greece, oil, rates; so many external factors these days overshadow earnings. What does the Fed need short term and long tern for earnings to say? How do they merge the two time periods? Confusion is the last thing the Fed needs now. they need either consistently bad or good, not in between. The markets want consistency now and are tired of this half and half crap they've been delivering over the past year or so.

On to the lie -

Now you tell me where to find the truth -

US retail sales rebound, post largest gain in a year

or

Retail Sales Misses For 4th Month In A Row For First Time Since Lehman

SPX 60m - Instead of battling critical support, price is now in a tussle with its first round of strong resistance. We've been watching this battle for some time now. Indicators are giving few clues as to direction.

Freedom Watch -

On the 1 year anniversary, the media and the government are still spinning the Bundy Ranch standoff misrepresenting the issues that led up to it and lying about what happened. See video here.

More to come below.

Have a good day.

GL and GB!

Monday, April 13, 2015

Morning Charts 04/13/2015 SPX /es

Ahhhh, going deep down the conspiracy trail on a Monday morning. What could be better. Zero hedge laid out two posts that got my juices flowing this morning. Fun stuff to read and think about until you realize that conspiracy fact has replaced conspiracy theory, and you are the sheeple, slave or hunk of meat at "their" disposal.

STB has discussed at length over the years about the BIS (Bank of International Settlements) being the kingpin of all. I hope you have listened. Recently we discussed the Rothchilds and Rockefellers and a warning about current conditions from them. Well, ZH has a post this morning that is a must read for those that truly want to know and understand their (your) lords and masters. Meet The Secretive Group That Runs The World is a post that lays it out nicely for you.

You were warned about the military industrial complex by Eisenhower. You were warned about secret societies by JFK. The Council on Foreign Relations is real. Bilderburg is real, The UN's Sustainable Development program is real (and boy do I bark up that tree a lot). It's all there for you to see if you choose to remove your head from the sand. These are the elite that control everything. Democracy? Freedom? .... Really? Shall I remind you of the Constitution Free Zones in the US? Unthinkable right? Try not, try reality.

On to the lie -

SPX Daily - Pretty simple - they have been in a large battle with critical support and now they are headed back to battle with critical resistance. SPX has been doing this for a month now. #FAIL ECB QE was a dud and did not provide the lift they desired. To the Fed's credit they did not need a "Bullard moment" to save a breakdown this time. They survived this round of Grexit and Greece actually gave their last dime to stave off collapse (till next month). The fed has lost the ability to lift (remember only Fed QE now will matter - no other works anymore), but apparently they can still muster a stick save when necessary. We're still in follow the Fed mode. It is their market. They control it (barely). Hang in there bears, your day is coming soon.

Freedom watch -

With all the discussion about potential coming wars and what may or may not cause them, sometimes we need a refresher course in false flags, state sponsored terrorism or the least probable, an actual non-instigated affair, to understand the real cause and not the propagandist purported cause.

Let's be clear, governments use these events to achieve other means as well. Need gun control? Need to increase domestic surveillance? Need to justify beefing up local police forces to resemble a force that's ready to invade Iran? This is no secret. It is real. Remember, they write the history books and control the MSM, so it's the internet's job to vet real history. Governments do dirty things, so with the current troubles our government is facing, maybe its time to take a peek into the past as a reminder that all is not what it appears to be, but more of what they want you to see. Please read - Twenty Years Later: Facts About the OKC Bombing That Go Unreported.

I suggest you read this history lesson. Tell me, does this situation sound familiar? Think O and Putin.

Let's go large this morning, take it deeeep, shall we - now add the BIS from above to the mix. Why? LOL, cause they are the profiteers, the greatest beneficiary of the wars. Who is in the greatest trouble right now? Who's in TBTF or TBTJ danger of the public's ire and being broken up after this next collapse? So the TBTF banks go cry to the central banks that go to their lord and master BIS for protection (think ultimate Mafia).

George Carlin put it best - wake up people.

More to come below.

Have a good week.

GL and GB!

STB has discussed at length over the years about the BIS (Bank of International Settlements) being the kingpin of all. I hope you have listened. Recently we discussed the Rothchilds and Rockefellers and a warning about current conditions from them. Well, ZH has a post this morning that is a must read for those that truly want to know and understand their (your) lords and masters. Meet The Secretive Group That Runs The World is a post that lays it out nicely for you.

"The bank’s opacity, lack of accountability, and ever-increasing influence raises profound questions— not just about monetary policy but transparency, accountability, and how power is exercised in our democracies."

You were warned about the military industrial complex by Eisenhower. You were warned about secret societies by JFK. The Council on Foreign Relations is real. Bilderburg is real, The UN's Sustainable Development program is real (and boy do I bark up that tree a lot). It's all there for you to see if you choose to remove your head from the sand. These are the elite that control everything. Democracy? Freedom? .... Really? Shall I remind you of the Constitution Free Zones in the US? Unthinkable right? Try not, try reality.

On to the lie -

SPX Daily - Pretty simple - they have been in a large battle with critical support and now they are headed back to battle with critical resistance. SPX has been doing this for a month now. #FAIL ECB QE was a dud and did not provide the lift they desired. To the Fed's credit they did not need a "Bullard moment" to save a breakdown this time. They survived this round of Grexit and Greece actually gave their last dime to stave off collapse (till next month). The fed has lost the ability to lift (remember only Fed QE now will matter - no other works anymore), but apparently they can still muster a stick save when necessary. We're still in follow the Fed mode. It is their market. They control it (barely). Hang in there bears, your day is coming soon.

Freedom watch -

With all the discussion about potential coming wars and what may or may not cause them, sometimes we need a refresher course in false flags, state sponsored terrorism or the least probable, an actual non-instigated affair, to understand the real cause and not the propagandist purported cause.

Let's be clear, governments use these events to achieve other means as well. Need gun control? Need to increase domestic surveillance? Need to justify beefing up local police forces to resemble a force that's ready to invade Iran? This is no secret. It is real. Remember, they write the history books and control the MSM, so it's the internet's job to vet real history. Governments do dirty things, so with the current troubles our government is facing, maybe its time to take a peek into the past as a reminder that all is not what it appears to be, but more of what they want you to see. Please read - Twenty Years Later: Facts About the OKC Bombing That Go Unreported.

I suggest you read this history lesson. Tell me, does this situation sound familiar? Think O and Putin.

"President Franklin Delano Roosevelt needed a war. He needed the fever of a major war to mask the symptoms of a still deathly ill economy struggling back from the Great Depression (and mutating towards Socialism at the same time). Roosevelt wanted a war with Germany to stop Hitler, but despite several provocations in the Atlantic, the American people, still struggling with that troublesome economy, were opposed to any wars. Roosevelt violated neutrality with lend lease, and even ordered the sinking of several German ships in the Atlantic, but Hitler refused to be provoked."

Let's go large this morning, take it deeeep, shall we - now add the BIS from above to the mix. Why? LOL, cause they are the profiteers, the greatest beneficiary of the wars. Who is in the greatest trouble right now? Who's in TBTF or TBTJ danger of the public's ire and being broken up after this next collapse? So the TBTF banks go cry to the central banks that go to their lord and master BIS for protection (think ultimate Mafia).

George Carlin put it best - wake up people.

More to come below.

Have a good week.

GL and GB!

Friday, April 10, 2015

Open Weekend Post 04/11-12/2015

You know the drill, share the love and the knowledge.

If you see it, share it. I will as well.

Have a great weekend.

GL and GB!

If you see it, share it. I will as well.

Have a great weekend.

GL and GB!

Morning Charts 04/10/2015 SPX /es

Cause 33% of everything to this market is buybacks - why not go full retard? This is soooo bubbleiscious! GE Announces One Of Largest Buybacks In History, Will Repuchase $50 Bn In Shares After Selling Most Of GE Capital

On to the lie -

SPX 30m - Well, they somehow managed to hold red support and finally push price through resistance, but the reception this morning was not all that reassuring was it? Those neg divs are fairly significant, nothing they have not seen or overcome before. They are there, yet again, signifying the Fed's ability to overcome or defy the markets natural desires. The past two weeks was one hell of a battle with critical support. There is a potential rising triangle in there (not drawn) targeting up to 2128. If that's all the pop that a (temporary) Greece resolution gave, they are in trouble.

Freedom watch -

LS2 is studying the Roman Empire this term in 8th grade history. It's always good to get a refresher course as a parent in most things. The parallels to the US today are quite spooky. When culture and values fail and greed and corruption take over, it historically has not worked out too well for empires.

Enjoy Masters Weekend.

More to come below.

Have a good weekend.

GL and GB!

On to the lie -

SPX 30m - Well, they somehow managed to hold red support and finally push price through resistance, but the reception this morning was not all that reassuring was it? Those neg divs are fairly significant, nothing they have not seen or overcome before. They are there, yet again, signifying the Fed's ability to overcome or defy the markets natural desires. The past two weeks was one hell of a battle with critical support. There is a potential rising triangle in there (not drawn) targeting up to 2128. If that's all the pop that a (temporary) Greece resolution gave, they are in trouble.

Freedom watch -

LS2 is studying the Roman Empire this term in 8th grade history. It's always good to get a refresher course as a parent in most things. The parallels to the US today are quite spooky. When culture and values fail and greed and corruption take over, it historically has not worked out too well for empires.

Enjoy Masters Weekend.

More to come below.

Have a good weekend.

GL and GB!

Thursday, April 9, 2015

Morning Charts 04/09/2015 SPX /es

Well, the Fed is obviously clueless. What now? Well, we wait I guess. It's their market. They will do what they want. Up or at least maintaining current valuations would be their preferred route. I suggest you read Peak Central Planning: BofA Says Fed's Dudley "Does Not Want Stocks To Decline; Wants Bond Prices To Go Down" for a glimpse at part of the Fed's propaganda. Remember, do what they do, not what they say.

On to the lie -

Nope, my record is not skipping. Sadly all there has been to look at for over a week now is red wedge support and the 2062 area. Not to belittle where we are, this is critical support.

SPX 60m -

Freedom watch -

Just another thing we've discussed regularly here on STB over the years. You know when I talk about them flipping the switch in times of trouble, cutting off power, water and such to control the population? Yeah, well, as usual, maybe I don't sound so crazy anymore. Smart Meters: Enforcement Of Mandatory Water Restrictions Is Only Just The Beginning

Masters starts today!

More to come below.

Have a good day.

GL and GB!

On to the lie -

Nope, my record is not skipping. Sadly all there has been to look at for over a week now is red wedge support and the 2062 area. Not to belittle where we are, this is critical support.

SPX 60m -

Freedom watch -

Just another thing we've discussed regularly here on STB over the years. You know when I talk about them flipping the switch in times of trouble, cutting off power, water and such to control the population? Yeah, well, as usual, maybe I don't sound so crazy anymore. Smart Meters: Enforcement Of Mandatory Water Restrictions Is Only Just The Beginning

Masters starts today!

More to come below.

Have a good day.

GL and GB!

Wednesday, April 8, 2015

Morning Charts 04/08/2015 SPX /es

Greece - it is a big deal, and their discussions with Russia are not making things any better.

And you should see this, realize the implications and heed its implications for the future of global banking - Swiss Government Becomes First Ever To Issue 10Y Debt At A Negative Yield.

On to the lie -

FOMC day, should get some sort of direction. Not sure how happy the markets will be especially if the Fed is gong to be as indecisive as it has been recently. I still prefer and lean south.

SPX Weekly - You tell me what you see. Now you know why I'm so focused on this wedge and the conditions surrounding it.

Freedom watch -

More to come below.

Have a good day.

GL and GB!

And you should see this, realize the implications and heed its implications for the future of global banking - Swiss Government Becomes First Ever To Issue 10Y Debt At A Negative Yield.

On to the lie -

FOMC day, should get some sort of direction. Not sure how happy the markets will be especially if the Fed is gong to be as indecisive as it has been recently. I still prefer and lean south.

SPX Weekly - You tell me what you see. Now you know why I'm so focused on this wedge and the conditions surrounding it.

Freedom watch -

Obama Criticizes Christians At Easter Breakfast Prayer

Obama Has Abandoned Israel

The question is, can we survive his rule for another two years?More to come below.

Have a good day.

GL and GB!

Tuesday, April 7, 2015

Morning Charts 04/07/2015 SPX /es

What else can you say? Just check out the charts in this post - The Warning Sign One Permabull Is Concerned About Is Now Flashing "Record" Red

On to the lie -

I'm gonna give you my favorite two charts right now, again.I think they simply tell the best story right now. It's a struggle between critical support and what's proving to be strong resistance (both technically and via lack of Fed intervention). FOMC Wednesday should cause a break one way or the other. I don't think the market will appreciate any indecisiveness from the Fed, so the odds of a move south outweigh a move north IMHO.

SPX 60m - The red rising wedge. Consolidation while battling with support and resistance at the critical bottom of the wedge.

SPX Daily - Wedge support and Diagonal of Death (black) resistance with weak internal support.

SPX Weekly - A different look with the weekly close.

Freedom watch -

I'll say it again - to words - hard to believe, but you better - Sustainable Development. Video: UN Climate Change Official Says “We Should Make Every Effort” To Depopulate The Planet

That's from the horses mouth - no conspiracy here. This is real.

As for the STB NCAA Challenge - RC makes late charge to take the title and Skysurfer passes STB to finish second. While disapointed that I did not take the title, I did find it hard to root against KY and Duke (SEC and southern teams) vying for the championship. So, I get the best of both worlds, a good showing, my friends had a good time and honestly the teams I wanted to win and do well did. All in all, another successful tournament. Thanks for playing.

It's Masters week!

More to come below.

Have a good day.

GL and GB!

On to the lie -

I'm gonna give you my favorite two charts right now, again.I think they simply tell the best story right now. It's a struggle between critical support and what's proving to be strong resistance (both technically and via lack of Fed intervention). FOMC Wednesday should cause a break one way or the other. I don't think the market will appreciate any indecisiveness from the Fed, so the odds of a move south outweigh a move north IMHO.

SPX 60m - The red rising wedge. Consolidation while battling with support and resistance at the critical bottom of the wedge.

SPX Daily - Wedge support and Diagonal of Death (black) resistance with weak internal support.

SPX Weekly - A different look with the weekly close.

Freedom watch -

I'll say it again - to words - hard to believe, but you better - Sustainable Development. Video: UN Climate Change Official Says “We Should Make Every Effort” To Depopulate The Planet

"There is pressure in the system to go toward that; we should do everything possible"

As for the STB NCAA Challenge - RC makes late charge to take the title and Skysurfer passes STB to finish second. While disapointed that I did not take the title, I did find it hard to root against KY and Duke (SEC and southern teams) vying for the championship. So, I get the best of both worlds, a good showing, my friends had a good time and honestly the teams I wanted to win and do well did. All in all, another successful tournament. Thanks for playing.

It's Masters week!

More to come below.

Have a good day.

GL and GB!

Monday, April 6, 2015

Morning Charts 04/06/2015 SPX /es

I'm at a loss on where to start with the commentary. So many places to go and so little time. Greece, wars, NATO buildup, terror, false terror, economy, government corruption, blah, blah, blah. It's funny, a recurring theme of STB over the years has been the Fed's juggling act. So many balls (bombs actually) in the air, additional balls being added to the act, sooner or later somethings going to hit the ground. They are beyond their capacity for being able to handle their task, but yet still somehow manage (mainly using smoke and mirrors). We're closing in on the point where even a corrupt manipulated system will not be manageable. Lord help us all when that happens.

I'm gonna back off on prognosticating cause I'm still a bit uncomfortable with trying to sort out where the Fed is headed. They have a move or two left, but no more. Greece is the wild card now. It could trigger a landslide of events uncovering the many cracks in the system domestic and globally. I suspect this will lead to the last great QE which will be the end of the line.

On to the lie -

Just watching the red rising wedge and the battle with critical support.

SPX Daily -

SPX 60m -

Freedom watch -

Last Week Tonight with John Oliver: Government Surveillance (HBO)

STB NCAA Tournament Bracket update - For the first time ever I believe I will win this one. Overall I'm in the 100% group ranked 323 out of the millions in the field, I am the Cinderella story of this years tournament. My major challenger this year put up a remarkable fight - all of RC's brackets (I lost count at how many entries he had) did really well. Thanks to all of you for participating. It's always a good time. Props to LS2 for a good showing. Dads like to see effort and a promising future.

More to come below.

Have a good week.

GL and GB!

I'm gonna back off on prognosticating cause I'm still a bit uncomfortable with trying to sort out where the Fed is headed. They have a move or two left, but no more. Greece is the wild card now. It could trigger a landslide of events uncovering the many cracks in the system domestic and globally. I suspect this will lead to the last great QE which will be the end of the line.

On to the lie -

Just watching the red rising wedge and the battle with critical support.

SPX Daily -

SPX 60m -

Freedom watch -

Last Week Tonight with John Oliver: Government Surveillance (HBO)

STB NCAA Tournament Bracket update - For the first time ever I believe I will win this one. Overall I'm in the 100% group ranked 323 out of the millions in the field, I am the Cinderella story of this years tournament. My major challenger this year put up a remarkable fight - all of RC's brackets (I lost count at how many entries he had) did really well. Thanks to all of you for participating. It's always a good time. Props to LS2 for a good showing. Dads like to see effort and a promising future.

More to come below.

Have a good week.

GL and GB!

Sunday, April 5, 2015

Friday, April 3, 2015

Morning Charts 04/03/2015 SPX /es

Early post -

Good Friday! Thank you Jesus! Uh, word to God, we could use a lot of intervention bout now .... anytime ur ready .... bring it.

On to the lie -

For literally years Ive had two charts that I thought had a great chance of timing the top. Ive really had 4 keys, these two charts, the STB event and QE4. As good as my 2118 short trade was, it may still not be the top, but then again there is that snowball's chance in hell.

SPX Weekly - Saved by the Bullard call, this one had a real chance. My weekly indicator support trendlines all failed. The VIX positive divergence is there. The first real correction started the week of my prognosticated point. Alas, Bullard came and screwed it all up.

SPX Monthly - Every great General has a backup plan! Here the April Fools point has been on this chart for years as well. The same indicator support diagonal theory holds here as well. Add Cycle timing to the weekly charts abuse and the neg divs on this chart screaming disaster, maybe this one will get it right. If not, I have no plan C other than run like hell.

SPX Monthly - and the longstanding STB target chart. I have not and I will never move that target box. At this time I believe it to be conservative. If I were to move it and go for a narrower range I'd not adjust the time scale at all, but I'd adjust the top and lower end down about 150 points.

Freedom watch -

I have not read this, but after all my dire warnings and my post yesterday, It prolly melds well. What Would Happen If Martial Law Was Declared In America? Actually, it's prolly tame compared to my view.

More to come below.

Best church music weekend of the year. STB luvs him sum Easter tunes.

NCAA tomorrow is gonna be awesome.

Masters next week is gonna be even better.

Flowers blooming and spring has sprung.

Have a great holiday weekend.

GL and GB!

Good Friday! Thank you Jesus! Uh, word to God, we could use a lot of intervention bout now .... anytime ur ready .... bring it.

On to the lie -

For literally years Ive had two charts that I thought had a great chance of timing the top. Ive really had 4 keys, these two charts, the STB event and QE4. As good as my 2118 short trade was, it may still not be the top, but then again there is that snowball's chance in hell.

SPX Weekly - Saved by the Bullard call, this one had a real chance. My weekly indicator support trendlines all failed. The VIX positive divergence is there. The first real correction started the week of my prognosticated point. Alas, Bullard came and screwed it all up.

SPX Monthly - Every great General has a backup plan! Here the April Fools point has been on this chart for years as well. The same indicator support diagonal theory holds here as well. Add Cycle timing to the weekly charts abuse and the neg divs on this chart screaming disaster, maybe this one will get it right. If not, I have no plan C other than run like hell.

SPX Monthly - and the longstanding STB target chart. I have not and I will never move that target box. At this time I believe it to be conservative. If I were to move it and go for a narrower range I'd not adjust the time scale at all, but I'd adjust the top and lower end down about 150 points.

Freedom watch -

I have not read this, but after all my dire warnings and my post yesterday, It prolly melds well. What Would Happen If Martial Law Was Declared In America? Actually, it's prolly tame compared to my view.

More to come below.

Best church music weekend of the year. STB luvs him sum Easter tunes.

NCAA tomorrow is gonna be awesome.

Masters next week is gonna be even better.

Flowers blooming and spring has sprung.

Have a great holiday weekend.

GL and GB!

Thursday, April 2, 2015

Morning Charts 04/02/2015 SPX /es

STB's worst nightmare, been discussing the possibility of it seemingly forever but really since when Syria started to get hot and heavy and everyone was freaking out - QE4. You need several angles on these things to figure out the hows, whens and whys of what the fed is going to do to continue the farce that can not die or else. This covers just one of the angles -

I've been discussing fear in the markets since August when I worked over the first top in this potential volatile topping scenario. This is when I started looking for the red rising wedge and here we are today with the wedge in place, fear increasing, economics faltering and the first potential QE4 trial balloon to be floated. I've told you that #QEFail by the ECB was a dud, and the only QE that would substantially matter would have to come from the Fed.

This will be their last ditch effort and will only allow them what time is left to prepare for the end. The greatest bulltrap of all time will come with this. This, QE4, is the only reason I have not called a top. In August of 2012 I told STB in a memorable tweet that we had entered a period of "unprecedented manipulation". This period will end when QE4 finally crushes what's left of the global financial system.

What follows the QE4 hint will be the government setting up for their end game scenarios. Now we bring in false flags, war (remember my big question - which comes first war or crash? and the fact I've believed since 2010 that Obummer would have to have a war for multiple reasons), nanny state, take the guns, fascism, UN sustainable development and all the other horror stories we've discussed over the years.

Look for the government to really up their efforts on controlling society. They have most of the pieces in place. The major ones, power, water and internet are right at their fingertips - we riot, they shut everything off, we come back begging for them to save us willing to submit to any demands they have - poof! America is gone.

We are honestly heading down this path I believe, so pay attention to any QE4 speak that may come. IMHO this will be the key to begin the early exit before the SHTF. Remember, all the way out, get your money out of their system and failing dollars and into real assets that you can physically own.

On to the lie -

I've stubbornly stuck to my bearish stance and my love affair with the 2062 s/r line, and the chart below. We're at a do or die point right before a major holiday that for the rare occasion and the first time in years has not had a major ramp associated with it. They see it, you see it, we all see the support that price is dangling on here. So, why have they not pulled us back from the brink with the potentially biggest Christian holiday and Passover upon us and the next blood moon just around the corner? Interesting thought there. Could it be STB "event" time? I don't think so, but one could make a very effective argument for the case. Anyway, you can't not think about such things. you must entertain every possibility.

SPX Daily - Support is cracking. To add to my QE4 thoughts from above, I've always been on a kick that they must induce fear and a lot of it for then to "have" to QE again. It's quite possible "the" top is set. A breakdown here to an 18 handle or the "Bullard" level and QE4 talk or even activation is quite possible. The bull trap back to 2062 or higher and then poof.

Freedom watch -

Biblical - California governor orders mandatory water restrictions this is really gonna mess things up. CA without water? This is one of the biggest economies on the planet. And ask yourself - if they can make it rain, which we know they can they do it all the time, then why are they not making it rain?

More to come below.

Have a good day.

GL and GB!

"The fact that March payrolls have missed on 6 of the last 7 reports probably adds to the dollar weakness, even if a huge miss tomorrow may just be the catalyst Yellen needs to launch the QE4 trial balloon. "

I've been discussing fear in the markets since August when I worked over the first top in this potential volatile topping scenario. This is when I started looking for the red rising wedge and here we are today with the wedge in place, fear increasing, economics faltering and the first potential QE4 trial balloon to be floated. I've told you that #QEFail by the ECB was a dud, and the only QE that would substantially matter would have to come from the Fed.

This will be their last ditch effort and will only allow them what time is left to prepare for the end. The greatest bulltrap of all time will come with this. This, QE4, is the only reason I have not called a top. In August of 2012 I told STB in a memorable tweet that we had entered a period of "unprecedented manipulation". This period will end when QE4 finally crushes what's left of the global financial system.

What follows the QE4 hint will be the government setting up for their end game scenarios. Now we bring in false flags, war (remember my big question - which comes first war or crash? and the fact I've believed since 2010 that Obummer would have to have a war for multiple reasons), nanny state, take the guns, fascism, UN sustainable development and all the other horror stories we've discussed over the years.

Look for the government to really up their efforts on controlling society. They have most of the pieces in place. The major ones, power, water and internet are right at their fingertips - we riot, they shut everything off, we come back begging for them to save us willing to submit to any demands they have - poof! America is gone.

We are honestly heading down this path I believe, so pay attention to any QE4 speak that may come. IMHO this will be the key to begin the early exit before the SHTF. Remember, all the way out, get your money out of their system and failing dollars and into real assets that you can physically own.

On to the lie -

I've stubbornly stuck to my bearish stance and my love affair with the 2062 s/r line, and the chart below. We're at a do or die point right before a major holiday that for the rare occasion and the first time in years has not had a major ramp associated with it. They see it, you see it, we all see the support that price is dangling on here. So, why have they not pulled us back from the brink with the potentially biggest Christian holiday and Passover upon us and the next blood moon just around the corner? Interesting thought there. Could it be STB "event" time? I don't think so, but one could make a very effective argument for the case. Anyway, you can't not think about such things. you must entertain every possibility.

SPX Daily - Support is cracking. To add to my QE4 thoughts from above, I've always been on a kick that they must induce fear and a lot of it for then to "have" to QE again. It's quite possible "the" top is set. A breakdown here to an 18 handle or the "Bullard" level and QE4 talk or even activation is quite possible. The bull trap back to 2062 or higher and then poof.

Freedom watch -

Biblical - California governor orders mandatory water restrictions this is really gonna mess things up. CA without water? This is one of the biggest economies on the planet. And ask yourself - if they can make it rain, which we know they can they do it all the time, then why are they not making it rain?

More to come below.

Have a good day.

GL and GB!

Subscribe to:

Posts (Atom)